Focus: Wellness. Medicare 101!

Tools tips and trick to help you take best advantage of your Medicare options

Untangling the Medicare ball of string

Photo by Universal Eye on Unsplash

OK, settle in kiddies, and remember, you asked for this! We’re going to go through a Medicare tutorial today. I’ll give you the basics of standard Medicare and help you with a couple of choices you’ll have to make. I won’t cover Medicare Advantage in this post. I’ll save that until next month. In that post, we’ll talk about choosing between standard Medicare and Medicare Advantage. (You can have one or the other, but not both.) Right now, we’re just going to get the basics so you can make a more educated decision next time. (By the way, if you’re planning on retiring early and are interested in non-Medicare healthcare coverage, please let me know in the comments or by replying to this newsletter. I won’t cover non-Medicate coverage unless I hear from you.)

Got your coffee? It’s after 4 and you’re wide awake? Grab some anyway. You may need it!

The Basics

The basic Medicare has 2 parts (A&B), but many people also opt for Part D, so I’ll talk about all three of them - and then to make things even more complicated, we’ll talk about Medigap at the end, so 4 “parts” in total. Why do we care how many parts and which ones we’re utilizing for what? Because each of them has (or may have) a premium, a co-pay and a deductible that are associated only with the spending from that part. Yep. You could be responsible for up to 3 separate premiums, co-pays and deductibles.

Part A

Part A covers nursing care, room and meals in a hospital or skilled nursing facility, home health services and hospice care. You don’t pay a premium for Part A if you or your spouse worked enough hours to earn 40 credits. If you don’t have enough credits, there is a graduated scale of premiums that you would pay, depending on how many credits you have. Part A applies a deductible for each hospital benefit period. After you have met the deducible ($1,408 in 2020) Medicare picks up the tab for up to 60 days. If you stay in the hospital for more than 60 days in any one benefit period, Medicare charges you a co-pay ($352/day in 2020) from the 61st to the 90th day. After 90 days, you can choose to draw on some of your lifetime reserve days. You have 60 of those for your entire lifetime and once they’re gone, they’re gone. If you choose to use these days for your stay, Medicare charges a large co-pay ($708/day in 2020). After that, you’re responsible for the full cost. Part A does not have a deductible for skilled nursing facilities after you have stayed in the hospital at least 3 days and they have determined you should go to a skilled nursing facility. Medicare will pick up the full cost for the first 20 days. After that, you’re responsible for a co-pay for the next 80 days ($176/day in 2020). And after 100 days, it’s all on you (which is why some people opt for long term care insurance). Once you have been out of care (either the hospital or skilled nursing facility) for 60 days, the clock resets and the whole thing starts all over again.

Part B

Part B covers doctor’s services in their facilities or at your home. It also covers some medical equipment and supplies (usually not disposable ones). Part B requires a monthly premium (144.60/month in 2020) unless you are eligible for government assistance. (Note: if your income is over a certain level, you may pay more.) Part B also has a deductible ($198 in 2020). After you have met that deductible, Medicare usually picks up 80% of the costs and you pick up 20% of the costs related to these benefits. There is no upper limit on these out of pocket costs. (However, if you choose to take a Medigap policy, some may cover these co-pays. We’ll cover that at the end of this article.)

Part D

Part D covers outpatient prescription medications. You may opt not to take Part D if you have other coverage, such as through your employer or through a medigap policy. You will purchase Part D insurance through third party providers. There are many to choose from and they are all different. They all charge a monthly premium, but they vary widely depending on many variables. There is a maximum deductible (in 2020 it was $435) but many charge below that and some charge none at all. You may have heard of the “donut hole.” This is in reference to Part D. Your deductible is set (again, at a maximum of $435 for 2020) at the beginning of the year. Once you meet that, you pay the co-pays up to a limit that the law sets ($4,020 in 2020). At that point, there is a coverage gap up to the out of pocket maximum set in law ($6,350 in 2020). That coverage gap, is known as the “donut hole.” Up to 2011, you would have been responsible for 100% of costs in that gap. The Affordable Care Act has changed that and Medicare picks up some of the costs. I could write a whole newsletter on this gap, but all Part D coverage is the same in this regard, so when you’re choosing a Part D policy, the donut hole looks exactly the same for all of them. (If you want more reading on the donut hole, see the further reading section, below.)

Choosing a Part D Policy

The main thing to note is that NO Part D policy covers all drugs. They each have what is called a formulary. That is simply a list of drugs that are covered by the policy. If the drug is not covered, you are responsible for the full cost. Medicare does require each policy to cover at least 2 drugs in each category of medication. And, it requires coverage of “substantially all” drugs in 6 categories (anti-cancer; anticonvulsant; antidepressant; HIV/AIDS; immunosuppressant; antipsychotic). The two things to be most diligent about, then, are the formulary and the cost (premium) of each of the policies you are comparing. Good news, here! Medicare has a handy-dandy comparison tool for comparing Part D policies called The Plan Finder. (One thing to note. This is a Medicare tool that compares third party policies, so the answer you get from the tool is only as good as the third party information that Medicare has. They do a lot of diligence to make sure the tool is up to date, but, around end of September to beginning of October each year, plans are updating their information in anticipation of the open enrollment period. Sometimes the information in the Medicare tool is less reliable during this period.) Make a list of all of your medications and plug them into the Plan Finder and it will tell you which plan covers the most of your medication the lowest cost. You need to make sure you have exact information about the name, the dosage and the frequency. If you enter these inaccurately, the output will be inaccurate. This is just the basics and the tool will likely give you several options for policies. You may not want to go with the cheapest one. Consider things like customer service scores, pharmacies supported and other restrictions as you make your final decisions.

Supplemental coverage (Medigap)

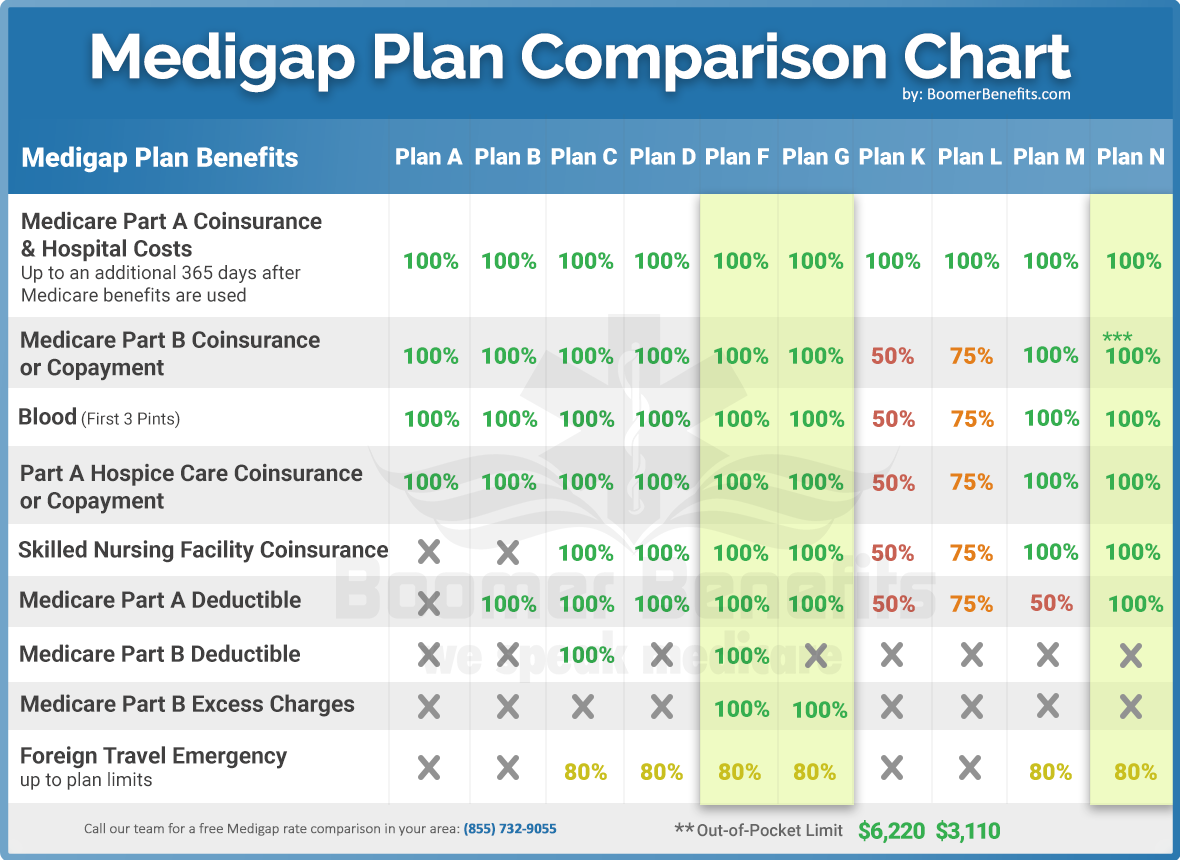

OK, you’ve got your Parts A,B&D covered. What about what’s left uncovered? If you’re concerned about premiums, deductibles or other out of pocket expenses eating up too much of your budget, you might want to consider a Medigap policy. These are also offered by third party insurers. The good news is that, while there are 8 (or 10) different coverage types, each represented by a letter (A, B, D, G, K, L, M, N) each type (letter) is identical in coverage regardless of the insurer that you go with. In other words, once you pick a coverage level, the only thing you are comparing is cost and service between the different insurers. The chart below gives you the coverages for each of the letters. (Note that the chart includes C coverage and F coverage levels. Those were eliminated in 2020. I include them in case you got your coverage before that.)

When you are looking at costs NOTE THE RATING. There are three different ratings, or ways to set the premium. Community Rating means you pay the same rate as the rest of the community who bought the same policy at the same time you did. This can be good if you live in a populous community like New York City. Issue Age Rating means the policy is set at the age you bought it and it can’t go up because of age after that. (Note that it can rise due to other factors like inflation.) Attained Age Rating means the premium is set based on the age you are when you bought the policy. It will go up each year because you are getting older. Attained Age policies may start out cheaper than the others, but may not end up that way over the lifetime of the policy. You can find insurers that offer Medigap insurance on the Medicare Website. If you’re going to get a Medigap policy the best time to do it is within 6 months of choosing to go with Medicare and signing up for Part B. This is because you have certain protections during this period. First, you can’t be refused; second, they can’t charge higher premiums because of your health (pre-existing conditions); and third they can’t impose a waiting period. You may purchase a Medigap policy after the 6 month period from signing up for Part B, but you won’t have those same protections.

Other things to note

Three more quick notes. First, Medicare coverage is for the INDIVIDUAL. All policies, premiums, deductibles, co-pays and the like, pertain to the person who is insured. No coverage extends to spouses or other family members. Each has to have their own policy and pay the premiums, deductibles and co-pays. Secondly, Medicare does not cover some costs, such as eye doctors, dentists, OTC medications, LTC insurance, etc. Here’s a pretty good list. Thirdly, be sure to sign up within 3 months of turning 65. If you do not you will pay a penalty FOR LIFE. Do NOT miss this window if you want to be covered by Medicare!

And that’s IT! You now have the information you need to decide whether standard Medicare is right for you, and if so, how to make the choices you’ll need to make to your best benefit!

More Reading

Can’t get enough? Here are some more resources to help you get up to speed on Medicare

The Medicare Bible (that I relied on heavily for this newsletter) is Medicare for Dummies. If you want in depth detail about Medicare and Medicare Advantage plans, this is the (425 page) book for you!

What is the donut hole? Details on costs in the coverage gap.

US News take on Part D providers.

Investopedia’s take on the best Medigap providers.

Missed the sweet spot? You said you wanted to hear about Medicare but this just didn’t answer your questions? Please let me know! Put your question in the comments or send them to me and I’ll answer them next time.

I am not old enough to take advantage of Medicare, yet. Those of you that are, did I miss something critical? What have been your experiences? Let us know in the comments!